td ameritrade tax calculator

Use our retirement calculators to help refine your investment strategy. Capital Gains Losses and Mythical Beings.

Sale Order Discount And Taxes Wrong Calculation R Netsuite

Mailing date for Forms 4806A and 4806B.

. In the results box highlight 1099-b then click GO. 1099-INT forms are only sent out if the interest earned is at least 10. Keep an eye out for W2s from your employer.

Federal tax-filing deadline and IRA contribution deadline. Our retirement income calculator determines how much you need to retire based on your current age income and health. TD AMERITRADE HOLDING CORPORATION ELLEN LS.

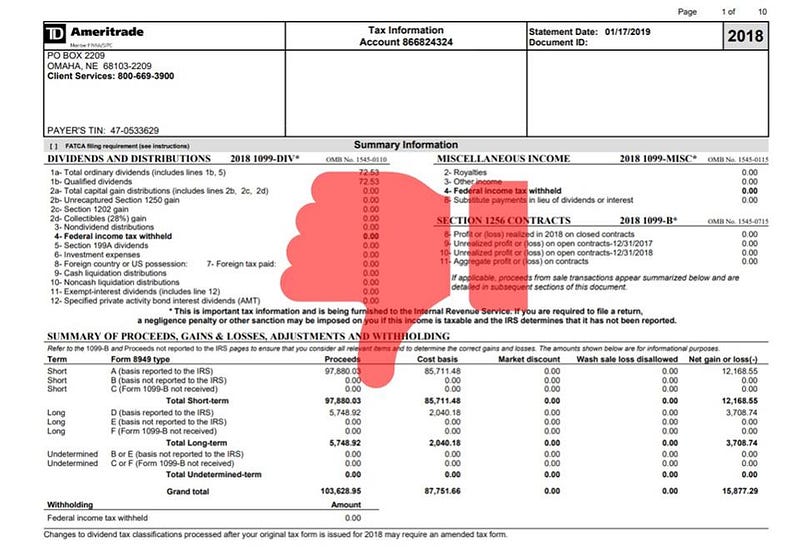

You will need to know your TD Ameritrade account number and your document ID. TD Ameritrade does not provide tax advice. Just select the data you want and export it in different formats.

Be sure to consult a financial professional prior to relying on the results. From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. Your tax forms arrive at home.

Trade for a Living. On the Analyze tab take a look at the Option Chain for the November 2020 options see figure 2. This includes month and year of hire birthdate and W-2 Income.

KOPLOW EMPLOYMENT AGREEMENT This Agreement originally entered into as of September 26 2006 by and between TD Ameritrade Holding Corporation the Company and Ellen LS. For illustrative purposes only. Census data on employees if applicable.

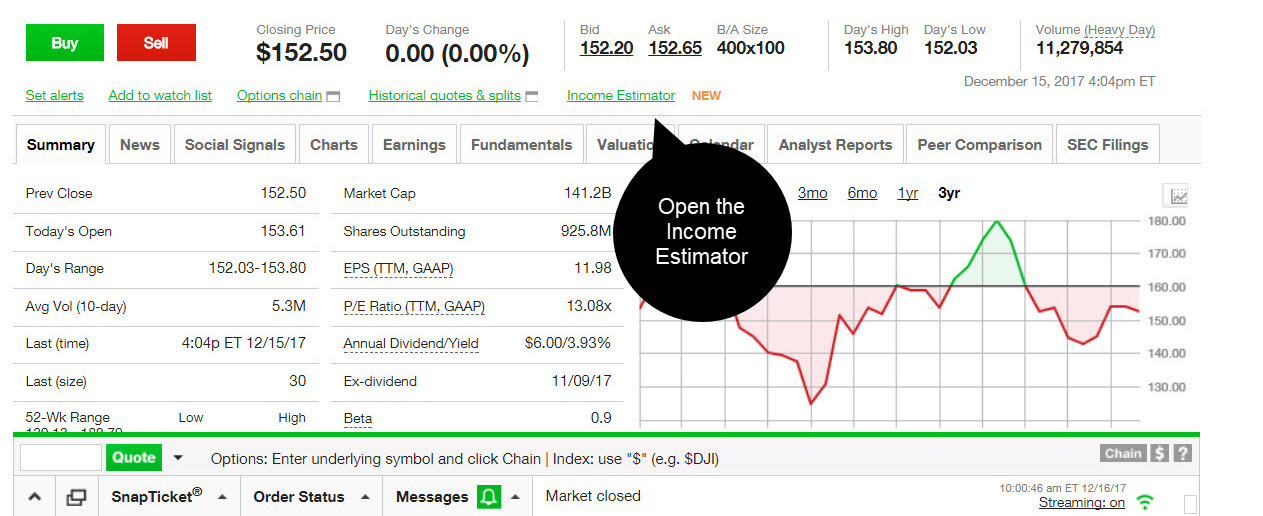

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. To import your TD Ameritrade account information into TaxAct. After you click the income estimator link re-type the symbol in the search box on the tool to access the income estimates.

Calculating it can be cumbersome but TD Ameritrade makes the process simple by doing most of the work. Koplow Executive is hereby amended and restated in its entirety effective as of October 13 2008 the Amendment Date. In the pop-up window select Topic Search.

If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. Click the Investment Income dropdown click the 1099 import from institution. Past performance does not guarantee future results.

Click Tax Tools lower left of your screen. You decide the resistance level of 140 would make for a suitable strike price. Mark-to-Market Trader Taxes 4 min read.

The information provided by these calculators is intended for illustrative purposes only and is not intended to purport actual user-defined parameters. TD Ameritrade is not responsible for the products services and policies. A 140 call costs roughly 1005 per contract or 1005remember that standard options control 100 shares of stock.

From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal. Were getting your 1099 and 1098 tax forms ready. Select TD Ameritrade from the Brokerage or software vendor drop-down menu.

All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Knowing cost basis can be helpful especially when it comes to preparing your taxes. Research provided by unaffiliated third-party sources.

Simplify the process of calculating contributions and determining employee eligibility in your business retirement plan with the Small Business Retirement Contribution Calculator. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account. In the Im looking for.

Some states may have lower tax rates within each federal tax bracket depending on the investors income level and type of filing. Mailing date for Form 1042-S and Real Estate Mortgage Investment ConduitWidely Held Fixed Investment Trust REMICWHFIT statements. Mailing date for Form 2439.

A leader in US. Click TD Ameritrade from the list of financial institutions. You should have received your 1099 and 1098 forms.

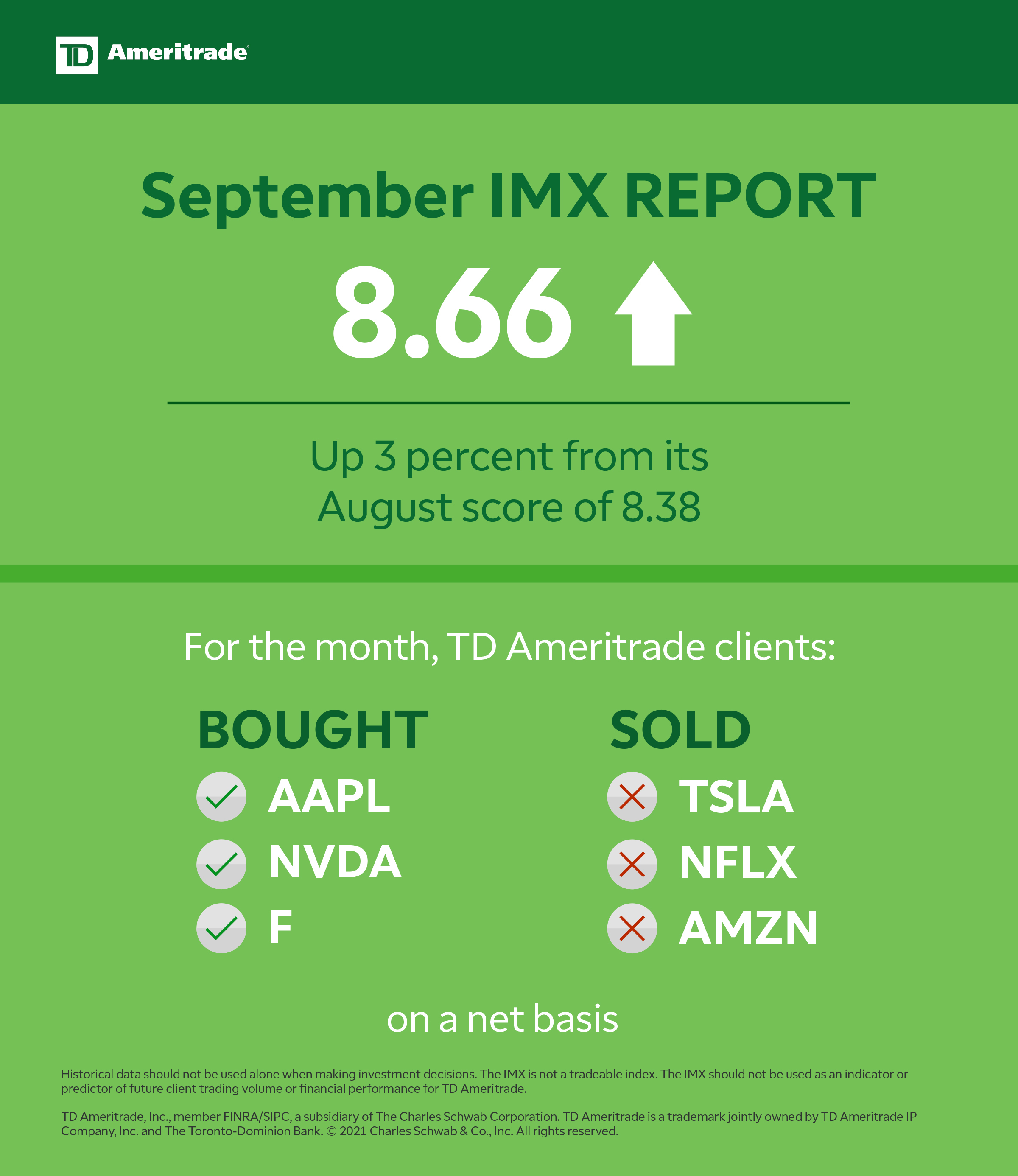

The TD Ameritrade Investor Movement Index IMXSM decreased to 642 in March down from 679 in February. TD Ameritrade wont report tax-exempt OID for non-covered lots. Late January to early February.

TD Ameritrade was evaluated against 15 others in the 2017 Barrons Online Broker Review March 18 2017. Form 1099 OID - Original Issue Discount. TD Ameritrade receives remuneration from mutual fund companies including those participating in its no-load no-transaction-fee program for recordkeeping shareholder services and other administrative and distribution services.

Click Stock Data Import. Your tax forms are mailed by February 1 st. Did you get a 1099-B or a brokerage statement for these sales.

Click Investment Income in the Federal Quick QA Topics menu to expand click Gain or loss on the sale of investments to expand then click Stock data import. TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. Tax code and for rollover eligibility rules.

We suggest you consult with a tax-planning professional with regard to your personal circumstances. Figuring out what you owe in income taxes might seem daunting but there are ways to make it easier. Calculate the required minimum distribution from an inherited IRA.

TD Ameritrade offers tips on how to calculate your income taxes where to find the a helpful income tax calculator the types of deductions you may be eligible for and more. Contribution and Eligibility Calculator. Please consult a legal or tax advisor for the most recent changes to the US.

The default figures shown are hypothetical and may not be applicable to your individual situation. Your document ID will be located on your TD Ameritrade statement or Form 1099-B. The amount of TD Ameritrades remuneration for these services is based in part on the amount of investments in such.

Enter your account number and document ID then click Continue. The calculator assumes the highest tax rate for the state you select. This TEY calculator is intended to be used only as a general guideline when determining taxable equivalent yields for fully taxable securities.

TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. TD Ameritrade does not provide tax advice. From within your TaxACT return Online or Desktop click on the Federal QA tab Click Investment Income to expand the category then click Gain or loss on the sale of investments Click Stock Data Import Click Electronic Import Select TD Ameritrade from the Brokerage or software vendor drop-down menu.

Youll land on Did you sell any investments in 2017. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Currency Converter Calculator Currency Calculators Download And Reviews Currency Converter Currency Converter

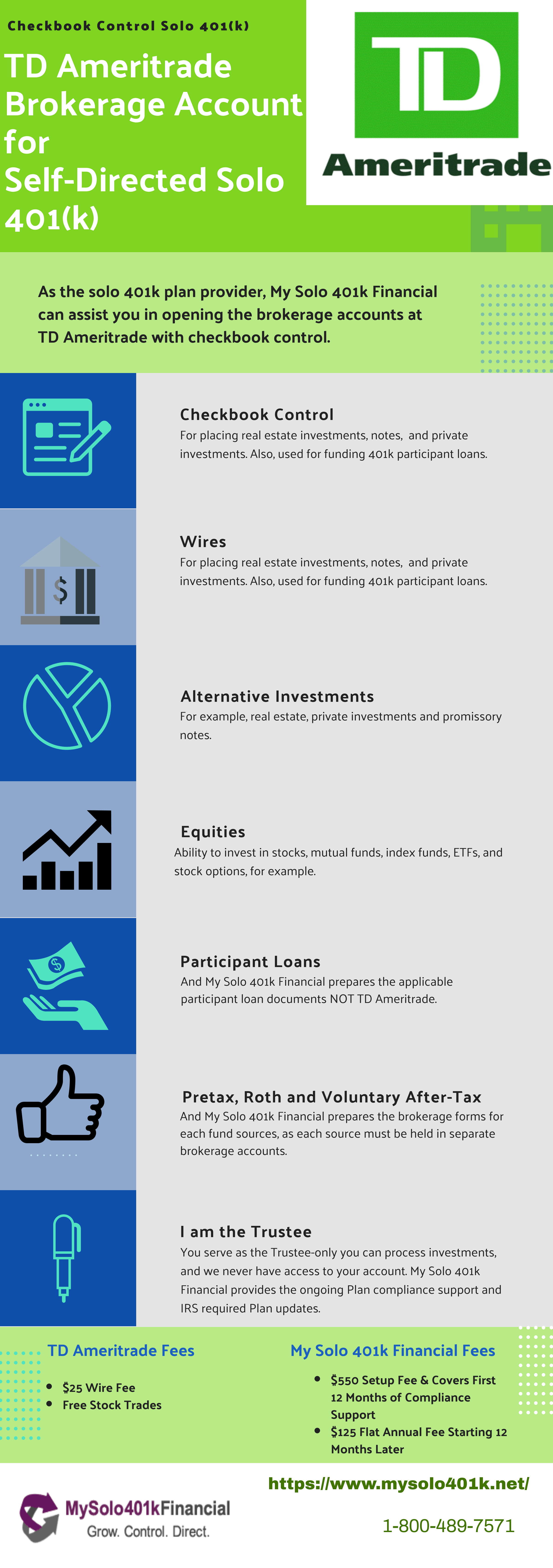

Ameritrade Solo 401k My Solo 401k Financial

See Your Allocations From The Inside Out With Portfol Ticker Tape

Tax Time Q A Where S Your 1099 Fort Pitt Capital Group

Can Someone Explain What It Means I Only Know It Belongs To Docusign And Is A Options Trading How Can We Calculate Initial Cost And Profit Made R Tdameritrade

Don T Get Blindsided The Importance Of Tax Return Es Ticker Tape

Td Ameritrade Investor Movement Index Imx Rises In September Business Wire

Choose The Right Default Cost Basis Method Novel Investor

What S My Potential Income The New Dividend Income E Ticker Tape

Pin On Making Money Financial Ideas

What S My Potential Income The New Dividend Income E Ticker Tape

Inherited Ira Rmd Calculator Td Ameritrade

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental Rental Property Rental Property Investment Sell Your House Fast

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)